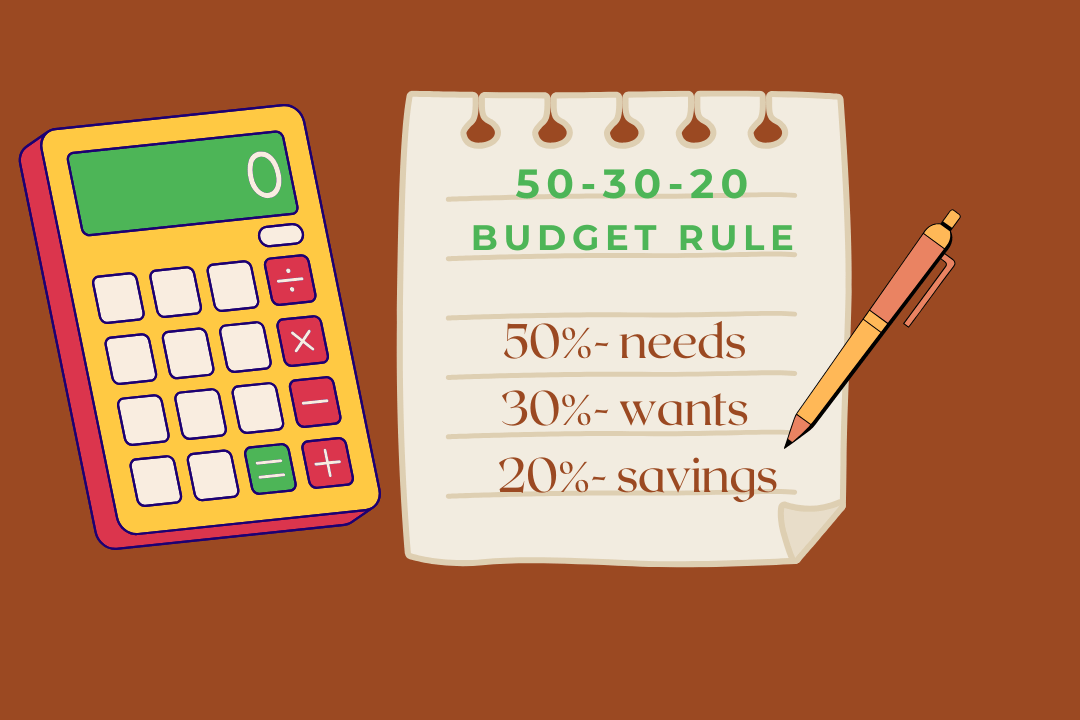

Entering the professional world is an exciting milestone, but it also brings new financial responsibilities. For young adults starting their careers, learning how to manage money early is the key to building long-term stability and success. From creating a realistic budget and saving for emergencies to avoiding debt traps, investing wisely, and planning for retirement, these personal finance tips will guide you toward financial freedom. By adopting smart habits now, you can take control of your income, achieve your goals faster, and secure a brighter financial future.