Introduction

Bad debt can feel like an overwhelming cloud hanging over your life. It influences your money-related well-being, your certainty, and in some cases, indeed your connections. But the great news is that obligation doesn’t have to characterize your future. With the right attitude and methodology, you can revamp your funds, recapture control, and make a brighter financial way ahead. Let’s investigate step by step how you can bounce back more grounded than ever.

Understanding Bad Debt

Bad debt more often than not comes from high-interest advances, unpaid credit cards, or borrowing cash without a clear repayment arrange. Not at all like “good debt” that might bring long-term esteem, like a student loan or contract, terrible debt drags your funds down. Recognizing the contrast is the to begin with step in your recovery journey.

Accepting the Situation

It’s enticing to disregard bills or dodge looking at your explanations, but confronting the reality of your financial circumstance is vital. Acknowledgment makes a difference; you take proprietorship and move toward arrangements instead of remaining stuck in denial.

Assessing Your Budgetary Position

List All Debts

Write down each obligation you owe, including equalizations, intrigued rates, and due dates.

Evaluate Pay vs Expenses

Compare how much cash you make against how much you spend. This will appear where your cash is spilling and how much you can designate toward repayment.

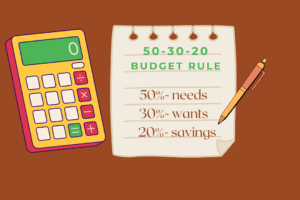

Building a Reasonable Budget

A budget is like a guide to recuperation. It tells your cash where to go instead of taking off it meandering. Prioritize fundamentals like lease, nourishment, and utilities, at then commit as much as possible to paying down debt.

Prioritizing High-Interest Debt

High-interest obligations, such as credit cards, ought to be handled to begin with since they develop the fastest. Utilizing strategies like the obligation avalanche (paying off the most noteworthy interest rate to begin with) or the obligation snowball (beginning with the smallest obligation) can make repayment more manageable.

Negotiating with Creditors

Did you know that numerous banks are open to transactions? Call them and inquire about decreased intrigued rates, expanded timelines, or obligation settlement alternatives. A basic phone call might spare you hundreds or indeed thousands.

Building a Crisis Fund

It may sound odd to save cash while paying obligations, but having a little crisis support keeps you from falling back into borrowing when unexpected costs hit. Begin with fair $500 to $1,000.

Improving Your Credit Score

Keep Credit Utilization Low

Aim to utilize less than 30% of your accessible credit.

Check Credit Reports

Look for blunders and debate them. A little rectification can boost your score a boost.

Finding Additional Wage Sources

Side hustles, independent work, or part-time occupations can quicken obligation reimbursement.

Avoiding the Traps That Caused Awful Debt

Reflect on what drove the obligation to begin with. Was it overspending, a need to arrange, or crises without investment funds? Recognizing the cause makes a difference; you dodge rehashing the same cycle.

Seeking Proficient Help

If things feel overpowering, credit counseling organizations or budgetary advisors can give organized reimbursement plans and counsel custom-made to your situation.

Developing Solid Budgetary Habits

Save some time recently spent.

Track costs regularly.

Use cash or charge to dodge depending on your credit.

Review your budget monthly.

Celebrating Little Wins

Paying off a little obligation, sparing $500 to begin with $500, or boosting your credit score are triumphs worth celebrating. They keep you propelled to continue the journey.

Long-Term Budgetary Planning

After clearing obligations, move the center to wealth-building. Begin contributing, develop your reserve funds, and arrange for retirement. Revamping your accounts is not just about getting away from obligations but about achieving financial freedom.

Conclusion

Rebuilding your funds after a terrible obligation takes time, tolerance, and commitment. The travel may feel moderate, but each step forward brings you closer to budgetary freedom. Keep in mind, it’s not around where you began but where you’re headed. With consistency, shrewd planning, and a positive mentality, you can turn monetary difficulties into an effective comeback story.

FAQs

How long does it take to recuperate from terrible debt?

It depends on the sum of obligation, wage, and reimbursement arrangement, but with teaching, numerous individuals see advancement in 1 to 3 years.

Ought I pay off obligations sometime recently, saving?

It’s best to do both. Center on high-interest obligation while keeping a little crisis fund.

Can obligation combination help?

Yes, uniting obligation into one lower-interest installment can disentangle reimbursement and decrease stress.

How do I remain propelled while paying off debt?

Set short-term objectives, track progress, and reward yourself for little milestones.

Is proficient budgetary counseling worth it?

Absolutely. A great counselor can make arrangements and arrange with banks on your sake