Introduction

Managing cash can be precarious, particularly when you’re sharing costs with a accomplice or raising kids. Between bills, goods, school expenses, and the incidental family excursion, cash frequently appears to vanish speedier than we’d like. The great news? With a small cooperation and a few shrewd methodologies, couples and families can save a considerable amount without feeling denied. Let’s investigate down-to-earth money-saving tips that can make a genuine difference in your ordinary life.

Why Saving Money as a Family Matters

Money-saving isn’t fair, almost cutting costs; it’s about building security, decreasing stress, and making more room for your family. When you save together, you get ready for startling crises, getaways, or indeed your children’s future education. Think of saving cash as planting seeds; the more reliable you are, the more your family will benefit later.

Set Shared Financial Goals

Talking approximately cash directly might feel cumbersome, but it’s one of the most critical steps. Couples who set monetary objectives together are more likely to succeed. Begin by characterizing both short-term and long-term goals.

Short-term objectives may incorporate saving for a family getaway or paying off small debts.

Long-term objectives might be buying a domestic, saving for college, or building retirement savings.

Having these objectives in composing gives your family a course and motivation.

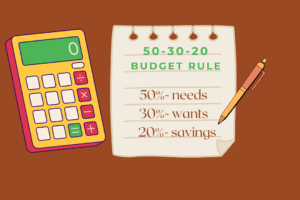

Create a Family Budget

Track your family’s pay and costs to see where the cash is truly going. You might be astounded at how much little every day buys add up.

Using free apps like Mint, YNAB, or indeed a basic spreadsheet can make budgeting simpler. Make beyond any doubt that each family part gets its budget, so it gets to be a shared obligation or maybe than a burden on one person.

Meal Planning and Smart Grocery Shopping

Food is one of the greatest family costs, but it’s one of the most effortless to manage.

Plan week after week of suppers in advance to dodge last-minute, costly takeout.

Buy non-perishable things in bulk to save cash long-term.

Get inventive with scraps to decrease food waste.

Shopping with a list, moreover, makes a difference when you adhere to the fundamentals instead of giving in to motivation buys.

Cutting Unnecessary Subscriptions

Take a closer look at month-to-month memberships. Do you truly require three gushing administrations? Are you paying for an exercise center participation you use once in a while? Cutting a few unused memberships can spare families hundreds of dollars each year.

Instead of numerous stages, consider pivoting services—use one for a couple of months, at that point switch to another. For wellness, try free YouTube workout recordings or open-air family activities.

Save on Utility Bills

Utility bills frequently eat up a great portion of family budgets, but little changes can lead to huge savings.

Switch to energy-efficient appliances.

Fix spills and introduce water-saving showerheads.

Teaching kids to be careful of power and water, moreover, makes long-lasting, great habits.

Affordable Family Entertainment

Entertainment doesn’t have to take a toll on a fortune. Instead of expensive trips to subject parks or cinemas, look for nearby free activities, family climbs, or indeed patio camping.

Game evenings with board diversions, Confucius, or handcrafted popcorn can be as fun—and a parcel cheaper—than going out.

Smart Travel Planning

Vacations don’t have to break the bank. If you arrange early, you can score cheaper flights and lodging. Consider staycations too—exploring adjacent attractions, parks, or verifiable locales can be shockingly reviving without depleting your wallet.

Traveling low season also makes a difference and cuts costs significantly.

Teach Kids About Money

Money lessons ought to begin at domestic. Allow kids a little stipend and energize them to save a portion of it. Straightforward challenges like “save $5 each week” make cash management fun.

This not as it were educates them obligations but also decreases the burden on guardians to support each little desire.

Embrace Second-Hand Shopping

Shopping second-hand is both budget-friendly and eco-friendly. Thrift stores, carport deals, and online marketplaces regularly have incredible finds at a fraction of the cost.

Emergency Support Planning

Every family ought to have a budgetary safety net. A crisis support makes a difference; you handle unforeseen costs like therapeutic bills or sudden work misfortune without falling into debt.

Save on Transportation Costs

Cars can be costly, but you can cut costs by carpooling, utilizing public transport, or biking when possible. If you drive routinely, keep your car well-maintained—simple activities like customary oil changes and tire checks anticipate greater repair bills later.

DIY Instead of Buying New

Before hurrying to purchase something modern, inquire if you can settle it yourself. Little domestic repairs, sewing a dress, or indeed making custom-made cleaning items can save families a lot.

Make it a family project—kids adore DIY exercises, and they’ll learn important skills too.

Plan for Big Purchases Together

Impulse buying can harm your budget. For bigger buys like hardware, furniture, or getaways, take time to compare costs and hold up for discounts.

Discussing enormous costs as a family, moreover, guarantees that everybody is on the same page financially.

Conclusion

Saving cash as a couple or family isn’t about living a gloomy life—it’s about making more astute choices that free up assets for things that really matter. Keep in mind that each dollar spared today builds a stronger future for tomorrow.

FAQs

What is the easiest way for families to save money fast?

Cutting pointless memberships and eating out less regularly are fast ways to see prompt savings.

How can couples avoid arguments about money?

By setting shared objectives and straightforwardly communicating about investment propensities, couples can dodge most conflicts.

Is it truly worth making a crisis fund?

Yes! A crisis fund gives peace of mind and avoids money-related stress amid startling situations.

How can families save on foodstuffs without compromising quality?

Meal planning, buying in bulk, and utilizing coupons or store rebates can altogether lower basic supply costs.

What’s a fun way to educate kids approximately saving?

Turn reserve funds into a game—like a family challenge to see who can spare the most in a month.